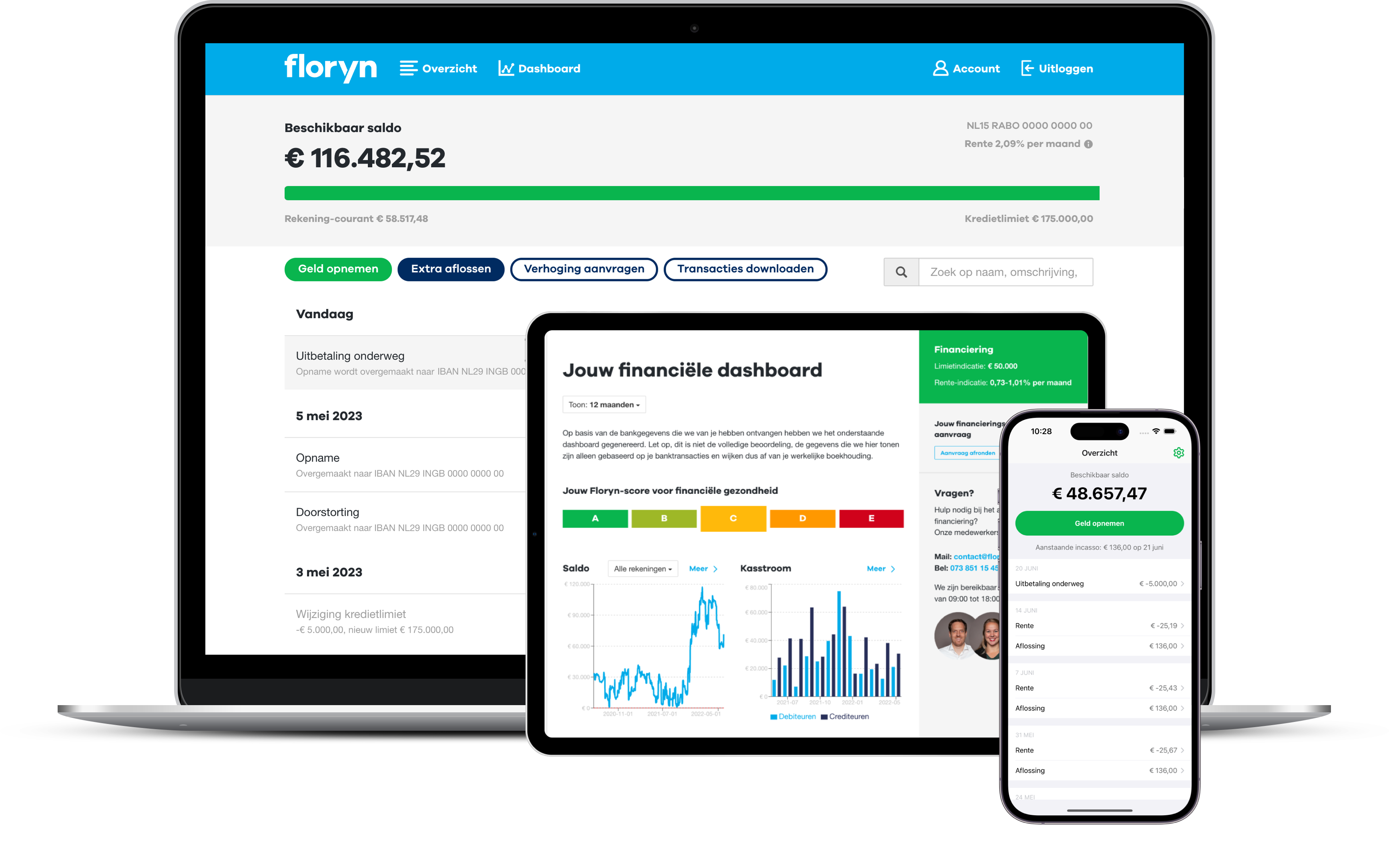

Floryn aims to be Europe’s best online business lender. Our technology directly impacts small and medium businesses, their owners and their employees.

Business growth is powered by financing. At Floryn, we provide loans in a different way than the traditional banks our customers are used to: we offer a delightful user experience and use our own credit model. That means our customers can use their business loan within hours instead of months — while keeping our loans responsible.

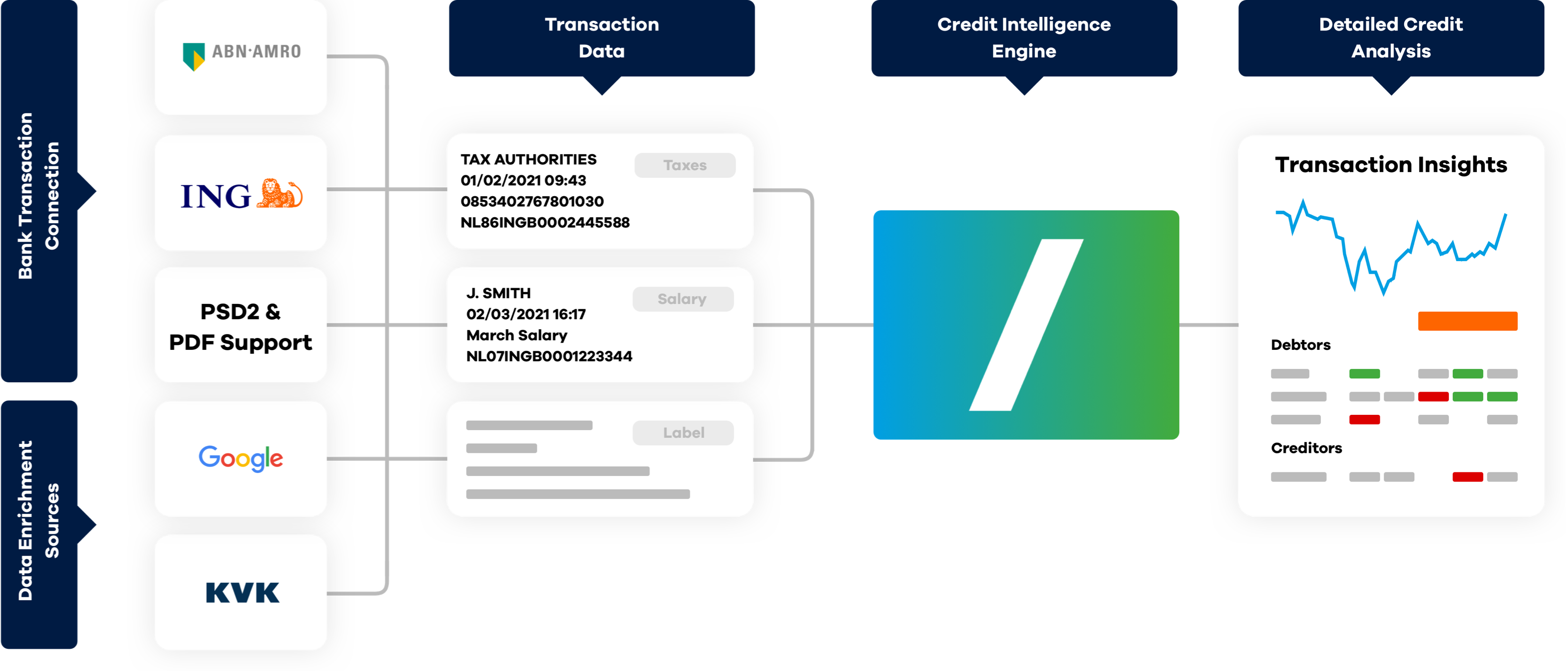

Our credit intelligence engine is based on transaction data we gather from business bank accounts. We obtain this data either via a PSD2-connection with our customers' bank, or by parsing their PDF bank statements.

We classify and aggregate these transactions into a credit analysis that our human underwriters can use, and into features for our machine learning models. This process is faster, easier, more timely and more accurate than traditional approaches.

Doing great work requires a favorable environment: a development budget, high-end gear, flexibility in where and when you work — but also a team to be a part of, experienced colleagues to learn form and the room to experiment, grow and have fun.

We aim to be a warm, welcoming place to work so that all can do their best work.

We use a modern open-source technology stack to develop rapidly, with confidence. We use Ruby on Rails heavily in our core application, combined with a sprinkle of React. Our machine learning-related work uses Python and for our infrastructure we use AWS, Terraform, Docker and more.

We have a technology-neutral mindset and believe in choosing the right tool for the job. We've adapted our techology stack over time, adding new pieces when we think that's appropriate.

Our development teams have software engineers, data scientists and data analysts with experience and a can-do attitude to technology. We can confidently give them challenges to take ownership of rather than tickets to implement. Such challenges range from securing our infrastructure and scaling our systems along with our ever-increasing pool of data, to optimising our end-user experience on different platforms.

We expect a lot from our people, and we have the development budget and opportunities to match.

Floryn is a fast growing Dutch fintech, we provide loans to companies with the best customer experience and service, completely online. We use our own bespoke credit models built on banking data, supported by AI & Machine Learning.